Update from Chamber Member - George Square Financial Management

November has been another strong month for financial markets as weaker inflationary data and a softer tone from the US Federal Reserve has lifted investor confidence. While the global economy is not out of the woods, the unrelenting pressure from higher policy rates may be about to subside.

Recession Alert:

Economic activity around the world has shown a distinctive dip in recent months as the impact of higher interest rates and a decline in consumer spending impacts businesses.

The UK economy has entered recession, registering its second month on month decline in GDP. The Chancellor’s autumn statement will saddle UK households with highest tax burden since the second world war and worsen consumer finances already reeling from higher energy prices.

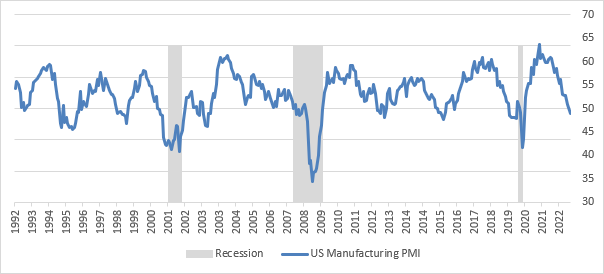

In the US, the all-important US Manufacturing managers’ survey reported its first reading below 50, a level associated with recessions.

Source – Bloomberg – 31/12/1992 to 30/11/2022

Housing demand on both sides of the pond have fallen sharply as consumer have struggled to finance higher mortgage costs. The gating of UK property funds has already started.

Inflation:

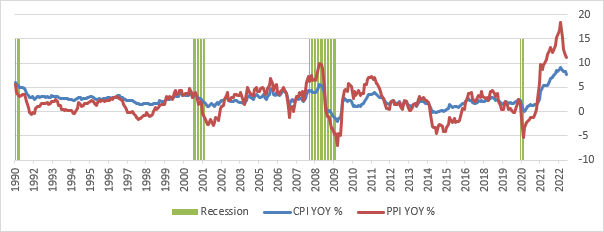

Source – Bloomberg – 31/12/1990 to 31/10/2022

US CPI data for October highlighted by the blue line - came in weaker than expected for October. Goods prices, a key part of post pandemic spike in inflation have now started to fall. Energy and food prices will start to show meaningful declines in the next quarter as we anniversary the post war spike in commodities. While inflation in the UK remains elevated, we believe the slowing economy and tighter monetary policy will help contain prices.

China

China’s Zero-Tolerance COVID policy has been at the centre of the storm this month. There is widespread discontent amongst the population of locked down cities, and domestic spending and manufacturing have come under strain. Riots at a Foxconn’s biggest iPhone factory in the city of Zhengzhou, highlights this unrest. The full opening of China relies heavily on the success of local vaccines, and a broader vaccination programme. The Chinese government will have to find a way to live with COVID to allow a recovery in its economy.

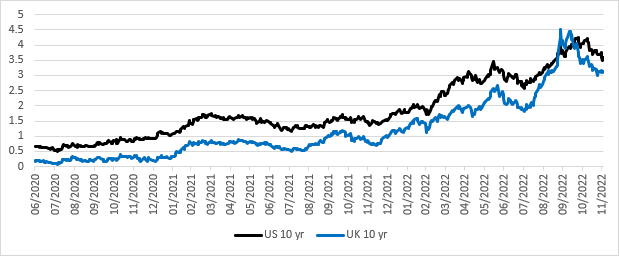

Bond rally

The rally in bonds started in October and has continued into November. The UK 10-year gilt yield, in blue, has declined sharply as the impending recession is priced into monetary policy forecasts. We have increased the duration of our bond holdings in a timely manner and allocated more to investment grade corporate issuers. Duration represents the sensitivity of a bond’s price to falling yields. As the recession begins, inflation should subside, allowing our bond holdings to recover.

Conclusion:

Our approach throughout 2022 has been to reduce sources of unintended risk within portfolios. We closely monitor market-based signals such as breadth, factor performance and risk sentiment and stand ready to take advantage of the discounts on offer when asset prices start to recover. Expected returns for a wide range of assets have improved significantly as inflation and recession risks are simultaneously being priced into a variety of asset classes. We are excited by the opportunity set we see ahead of us in 2023.

© 2022 George Square Financial Management Ltd. All Rights Reserved

The content of this material is a marketing communication, and not independent investment research. As such, the legal and regulatory requirements in relation to independent investment research do not apply to this material and it is not subject to any prohibition on dealing ahead of its dissemination. The material is for general information purposes only (whether or not it states any opinions). It does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) legal, financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Albemarle Street Partners or George Square Financial Management Ltd that any particular investment, security, transaction or investment strategy is suitable for any specific person. Although the information set out in this marketing communication is obtained from sources believed to be reliable, Albemarle Street Partners or George Square Financial Management Ltd. makes no guarantee as to its accuracy or completeness. Neither Albemarle Street Partners or George Square Financial Management Ltd. shall be responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. This material may include charts displaying financial instruments' past performance as well as estimates and forecasts. Any information relating to past performance of an investment does not necessarily guarantee future performance.

Albemarle Street Partners is a trading name of Atlantic House Fund Management LLP who is authorised and regulated by the Financial Conduct Authority. George Square Financial Management Ltd. is authorised and regulated by the Financial Conduct Authority.