George Square Financial Management in conjunction with Albemarle Street Partners.

Our latest client report for the start of 2023

I believe we all are pleased to see the back of 2022. Throughout last year inflation surged, and Central Banks responded with rapid increases in interest rates. This resulted in the lowest portfolio returns since the global financial crisis in 2009.

So, is it right to welcome 2023 by asking, when can markets be expected to begin their recovery? More importantly we must ask; how can we ensure that your portfolio properly participates in that recovery?

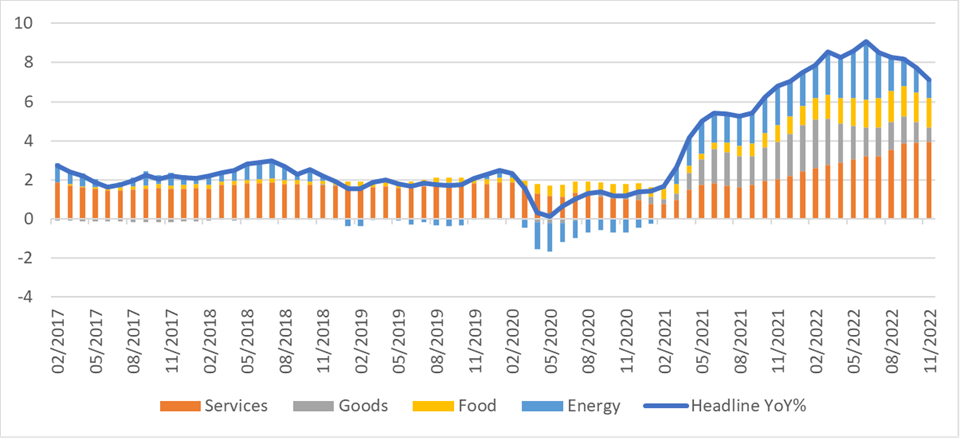

Good news did start to emerge in the final months of 2022 as co-ordinated monetary tightening and falling consumer demand caused a rapid deceleration in inflation. US inflation (highlighted below) appears to have peaked, and we should see a meaningful drop in reported inflation across the developed world in the coming months.

Source – Bloomberg 02.2017 to 11.2022

Energy, food, and goods prices have started to decline month on month and service inflation has started to moderate as well.

At times like this it becomes necessary to claim that inflation will take a very long-time to fall. Many people like to play it safe and sound as bearish as possible during a crisis for fear that optimism makes them appear naïve. However, the falling path of inflation has now been established in the United States for six months and there is evidence that in the Eurozone it is falling sooner than many anticipated.

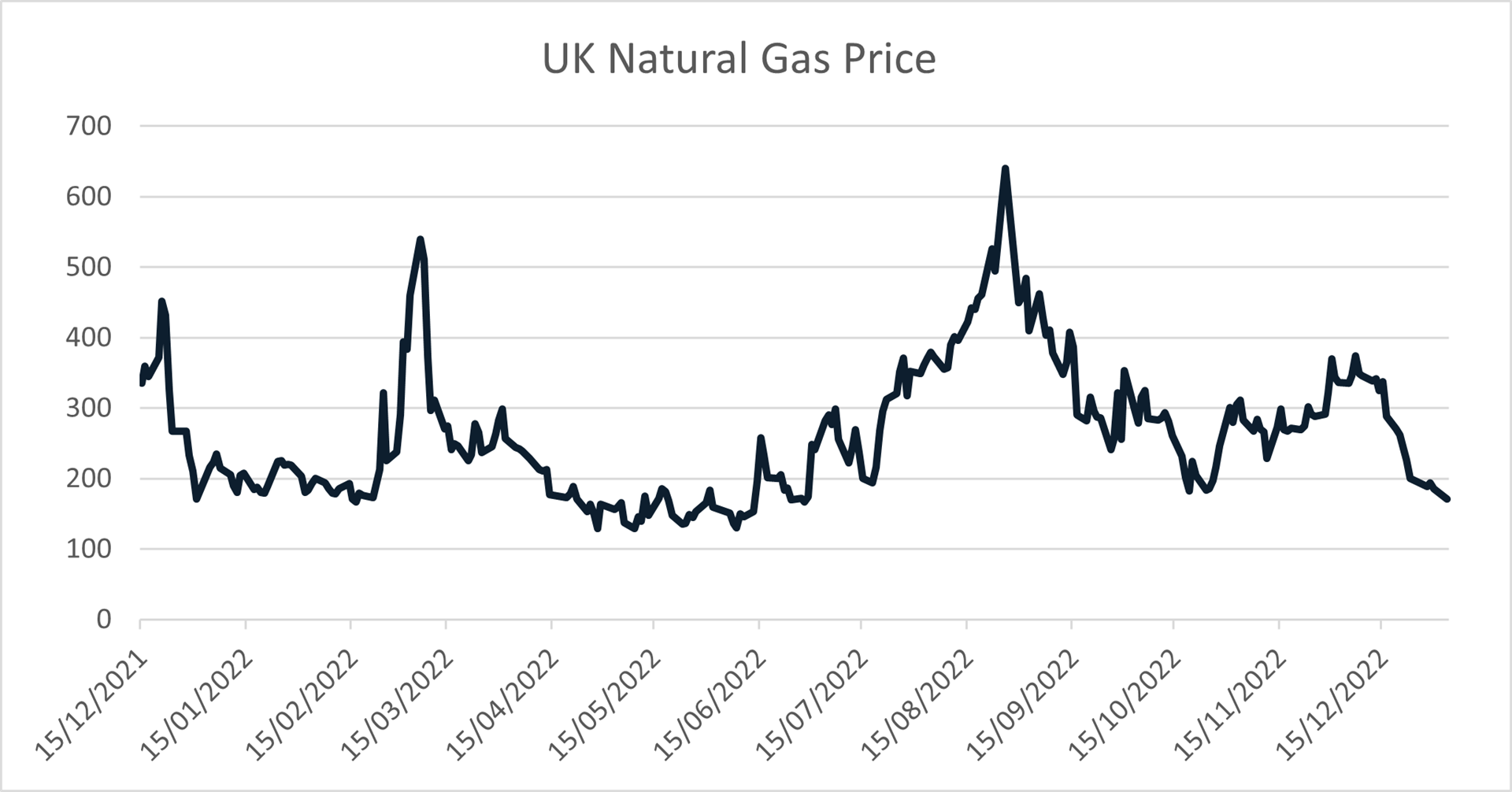

The case for a faster decline in inflation is gaining traction as goods and energy prices have started to fall sharply. UK and European inflation figures are sensitive to the price of natural gas (shown below) which has fallen by 50 per cent in the last month alone. Crude oil prices are in line with 2021 levels and food prices are likely to face pressure from increased production in 2023.

Source – Bloomberg 12.2021 to 01.2023

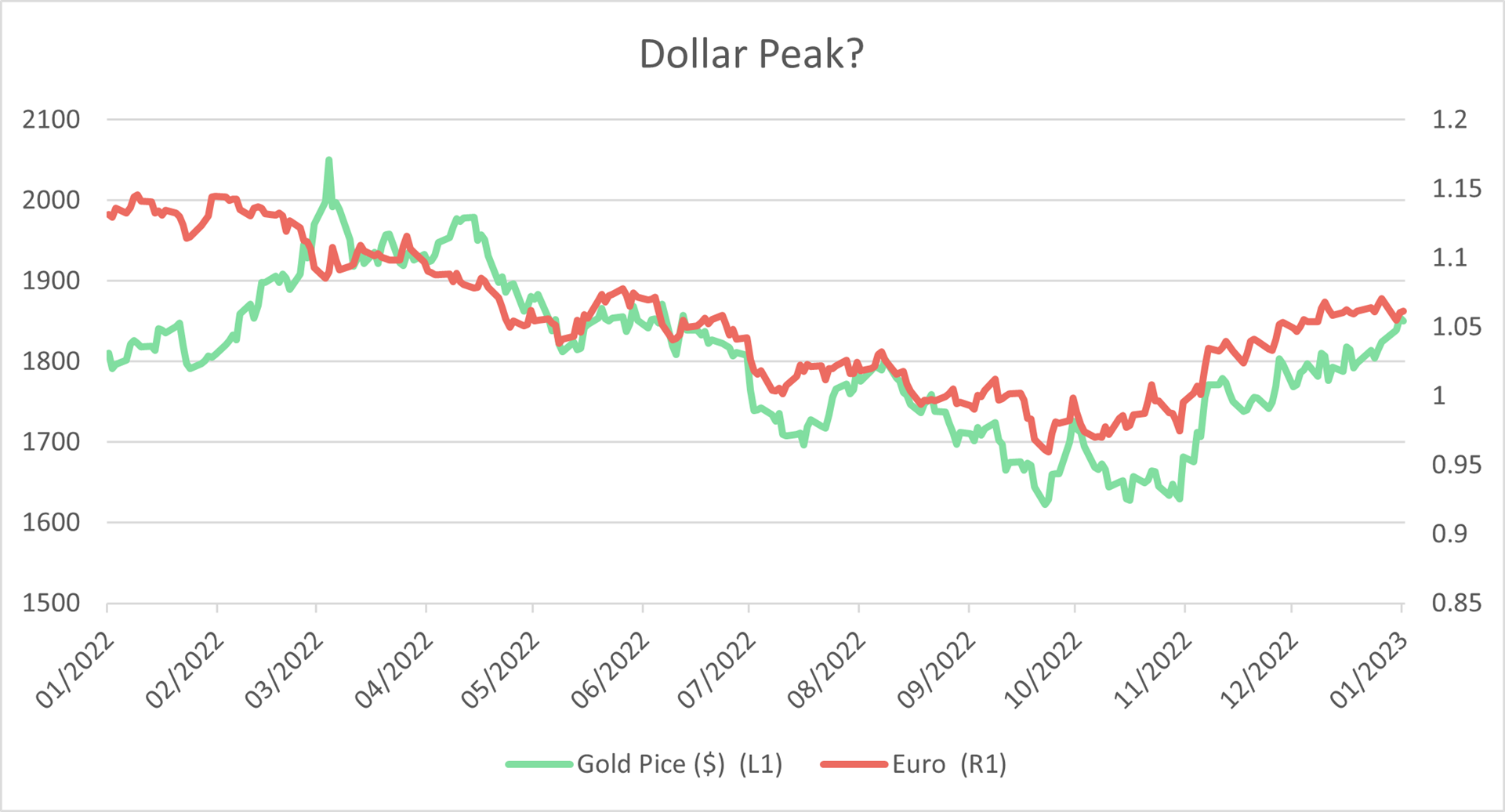

Source – Bloomberg 01.2022 to 01.2023

The peak in US bond yields has caused the US dollar to fall, after rallying for much of 2022. The rally in the Euro versus the dollar (above) is mirrored by the move in sterling, the yen and gold (also above). The selloff in the dollar heading into a global recession is strange but not unusual. Crowded positioning in haven assets can unwind during risk rallies and it is important to recognise the diversification benefits the holdings provide. Just like bonds, the dollar allocations have a role to play in long term asset allocation.

Financial conditions throughout the developed world have tightened materially. The implication of this will become more apparent in 2023. House prices are falling across the developed world and manufacturers have started to curtail production to match falling orders. Corporate earnings have started to decline and layoffs in a variety of sectors are making headlines.

We anticipate a slowdown in global economic activity in the first half of 2023, before a recovery late in the year. 2022 earnings have surprised positively as companies in a variety of sectors have delivered better revenues through the higher prices. While corporate earnings will come under pressure, we expect earnings growth to resume in the second half of 2023. Small-cap equities and value-tilted strategies could suffer severe drawdowns during the recession, and we have taken steps to mitigate this risk.

Our investment approach is data driven, forward looking, and focused on the long-term. This allows us to look through the here and now and focus on opportunities as they become available.

The value of investments can go down and you may get back less than invested. This material may include charts displaying financial instruments' past performance as well as estimates and forecasts. Past performance does not predict future returns. © 2023 George Square Financial Management Ltd. All Rights Reserved. The content of this material is a marketing communication, and not independent investment research. As such, the legal and regulatory requirements in relation to independent investment research do not apply to this material and it is not subject to any prohibition on dealing ahead of its dissemination. The material is for general information purposes only (whether or not it states any opinions). It does not consider your personal circumstances or objectives. Nothing in this material is (or should be considered to be) legal, financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Albemarle Street Partners or George Square Financial Management Ltd that any particular investment, security, transaction, or investment strategy is suitable for any specific person. Although the information set out in this marketing communication is obtained from sources believed to be reliable, Albemarle Street Partners or George Square Financial Management Ltd. makes no guarantee as to its accuracy or completeness. Neither Albemarle Street Partners or George Square Financial Management Ltd. shall be responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Albemarle Street Partners is a trading name of Atlantic House Fund Management LLP (AHI). Issued by AHI who is authorised and regulated by the Financial Conduct Authority. Registered Office: 135 Bishopsgate, 8th Floor, London, EC2M 3TP. George Square Financial Management Ltd. is authorised and regulated by the Financial Conduct Authority